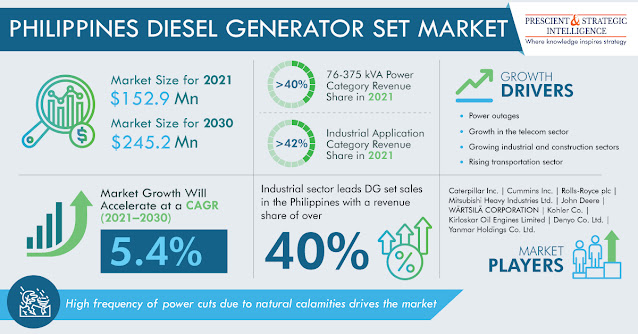

The Philippines diesel generator market was $152.9 million in 2021, and it is set to reach $245.2 million by 2030, growing at a CAGR of 5.4% through 2021−2030. The main reason for this is the developing industrial sector, which, in turn, is increasing the demand for electricity, and the frequent power outages. The market is also expected to grow with the growth in the urban population, which is leading to the mass-scale construction of commercial spaces, such as hotels, shopping malls, stadia, and transport hubs.

The Philippines diesel generator set market revenue is also snowballing at a faster pace because the government is trying to attract FDI. The country has established monetary zones to entice foreign companies and aid them set up production facilities. For example, the net FDI flow into the Philippines augmented by 96% year on year, to $1.1 billion in November 2021, in the sixth successive month of development among constant economic improvement.

Industrial gensets held over 40% Philippines DG set market share in the application segment in 2021 due to the ongoing industrial projects. For example, DMCI Holdings, in August 2021, publicized plans to invest $70 million in developing of two electricity plants. Of this, $54.8 million was for a thermal power plant project on Palawan Island, and the rest for a hybrid diesel–solar power plant in Cataingan, Masbate. Upon operation, there will be a reduction in the cost of energy, and the r production capacity of DMCI will go up to 164 MW.

There is also a strong need to develop the transportation infrastructure in the Philippines to decrease the traveling time. In January 2020, the Philippines’ Department of Transportation confirmed a joint venture with three Chinese firms for the expansion of the first package of the Philippine National Railways South Long-Haul project (PNR Bicol). The design, construction, and electromechanical works on the initial 380-km stretch from Banlic, Calamba to Daraga, Albay, are to cost $2.76 billion under this project.

Therefore, the market is growing in the Philippines because of the constant power outages and natural disasters hitting the country.