Italy's material handling machinery market is on a trajectory of significant growth, projected to expand from USD 4.6 billion in 2024 to USD 6.35 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.5%. This surge is attributed to advancements in automation, a robust manufacturing sector, and the increasing demands of the e-commerce industry.

Automation and E-commerce Driving Demand

The integration of automation technologies is

revolutionizing Italy's industrial landscape. Manufacturers are increasingly

adopting automated guided vehicles (AGVs), conveyor systems, and smart

forklifts to enhance operational efficiency. This shift not only streamlines

logistics but also addresses labor shortages and reduces operational costs.

E-commerce, a significant contributor to this growth,

demands rapid and accurate order fulfillment. The need for advanced material

handling solutions to meet these demands has led to increased investments in

automated systems. Companies are focusing on green equipment that reduces

carbon footprints while enhancing energy efficiency, aligning with global

sustainability goals.

Diverse Applications Across Sectors

The market's expansion is not confined to a single sector. Transport,

energy, and water infrastructure projects are the largest end-users, reflecting

Italy's commitment to modernizing its public services. Residential housing is

also witnessing growth, with a CAGR of 3.3%, driven by urbanization and

government incentives promoting home building and renovations.

Contractors dominate the customer segment, accounting for

61.8% of the market in 2024. Their reliance on a diverse range of material

handling equipment underscores the importance of versatility and adaptability

in machinery offerings. Rental companies are emerging as a fast-growing

segment, with a CAGR of 6.4%, due to the flexibility and cost-effectiveness

they offer, especially to small and medium-sized enterprises.

Technological Innovations Fueling Growth

Product innovation remains a cornerstone of market growth. Companies

are introducing smart machines equipped with IoT capabilities for real-time

monitoring and analysis, enhancing process efficiency and reducing downtime. Automation

technologies, such as self-moving forklifts and robotic palletizers, are

addressing labor shortages and increasing operational throughput.

The shift towards electric propulsion is notable, with

electric material handling machinery projected to grow at a CAGR of 25.4%. This

trend is fueled by environmental concerns, regulatory pressures, and the

benefits of reduced noise pollution and lower maintenance requirements

associated with electric equipment.

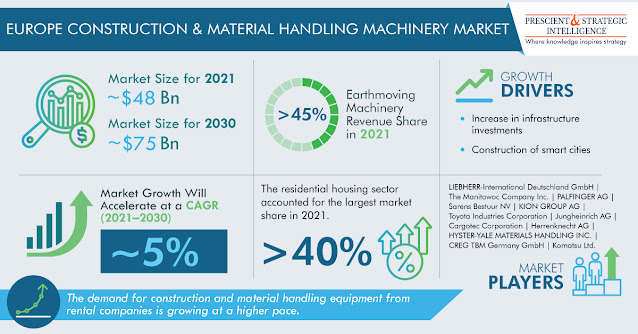

Competitive Landscape and Future Outlook

Italy's material handling machinery market is characterized

by fragmentation, with numerous original equipment manufacturers (OEMs)

offering a wide array of products. Key players include LIEBHERR-International

Deutschland GmbH, Caterpillar Inc., AB Volvo, Sany Heavy Equipment

International Holdings Company Limited, and Komatsu Ltd. This competitive

environment fosters continuous innovation and strategic pricing, compelling

manufacturers to enhance their offerings to attract and retain customers.